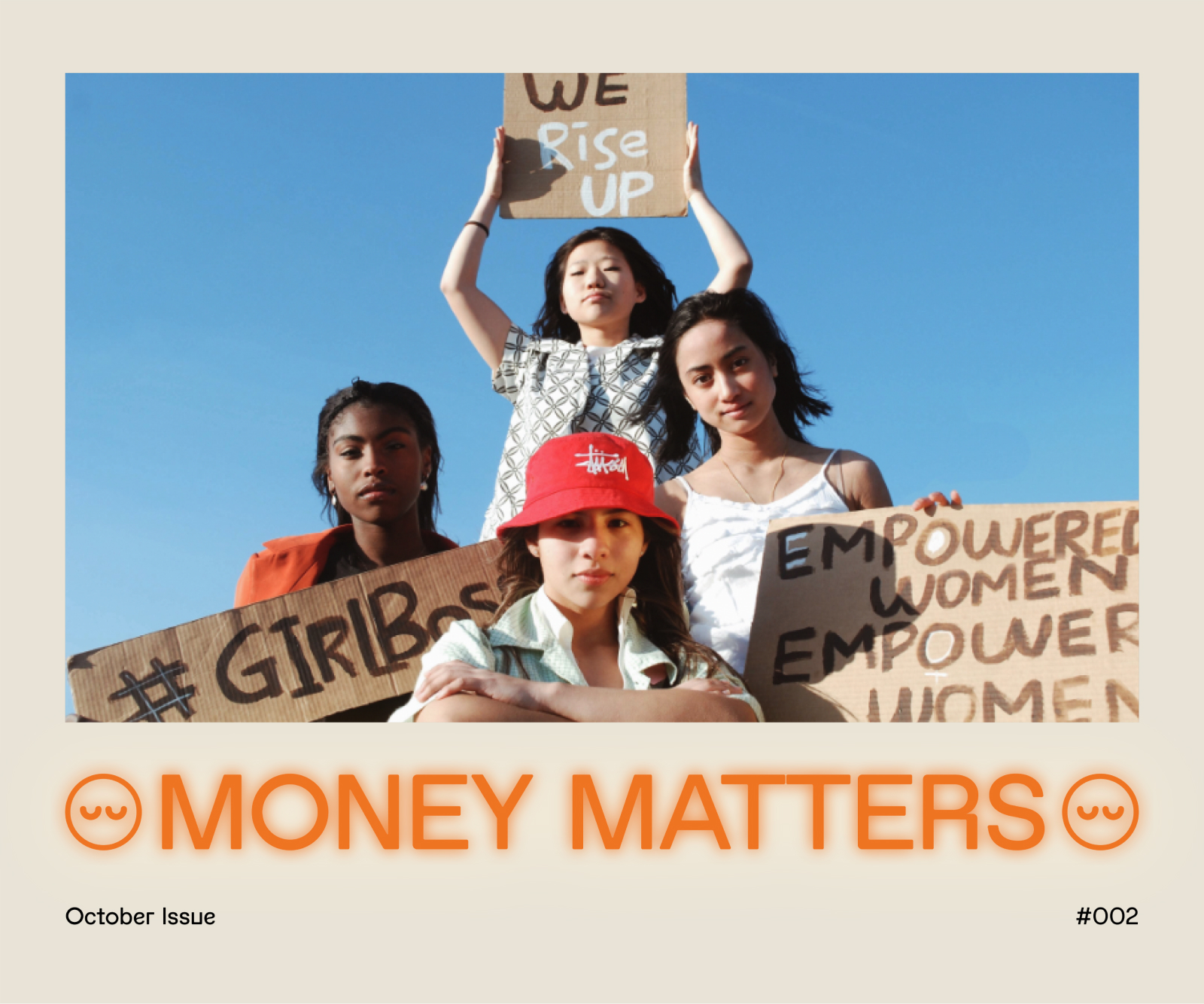

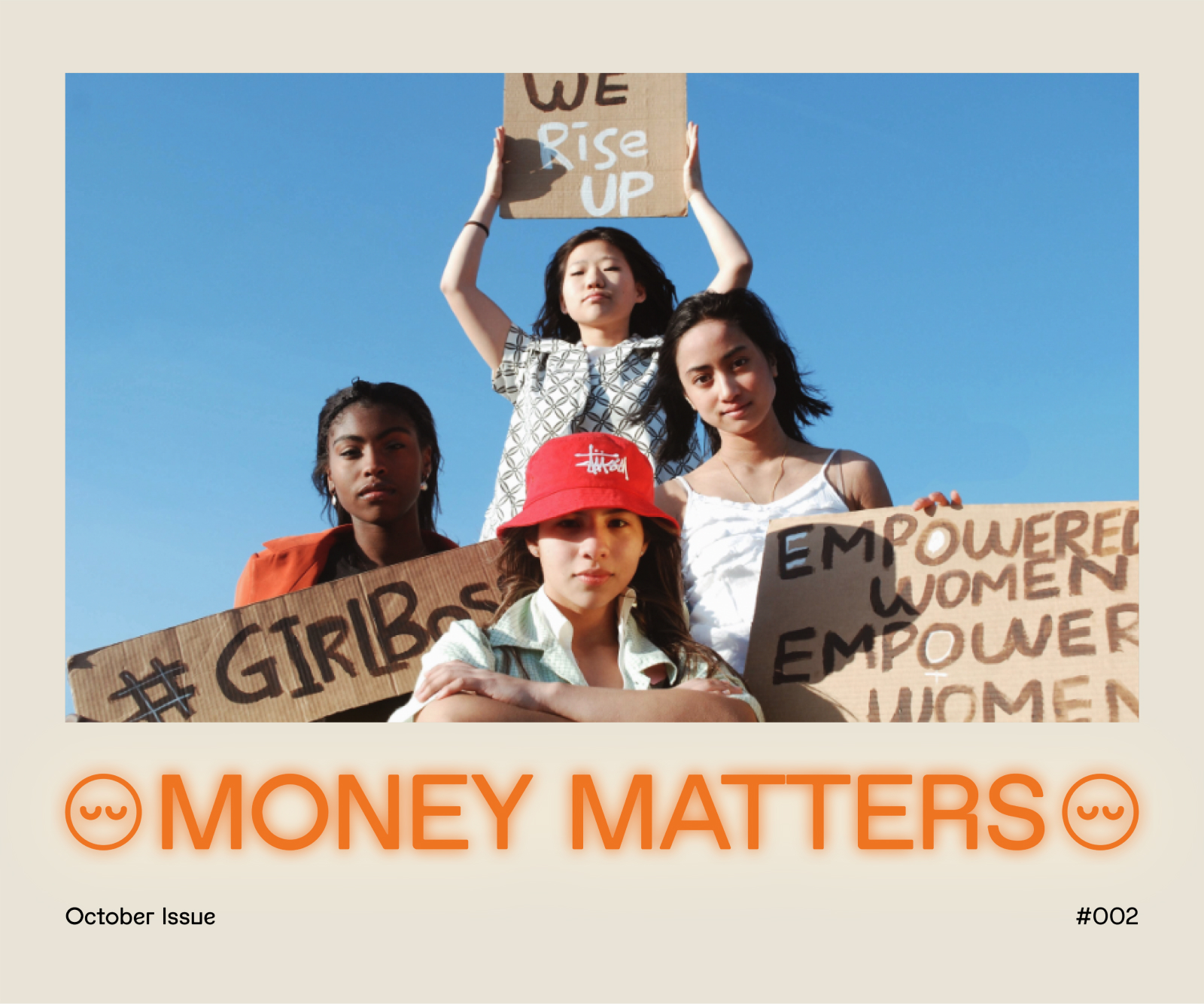

How Saving Is In Fact A Feminist Issue?

Overall, women still tend to invest less and later than men, meaning we can miss out on many of the benefits of allowing our money to grow over time and end up with significantly less wealth than men have by retirement. A study by the Chartered Insurance Institute found that by the age of 60 to 64, women in the U.K. have an average pension wealth of £35,700—just 25 percent of the amount held by men, on average.

Pretty much everyone can benefit from investing. And once you get into the habit of doing it regularly, you can grow your wealth with every paycheck.

But women aren’t often raised to think of ourselves as wealth-builders, or taught or encouraged to invest for ourselves—at least not outside of contributing to a company pension account. Just one in five women in the U.K. hold an investment, compared to one in three men. And the value of investments held by women between 21 and 53 years old was around half that of men in the same age group, according to a study by research firm Kantar TNS.

And the gap doesn’t seem to be improving as younger women enter the labour force. The same analysis found that 40 percent fewer millennial women are investing outside of an employer retirement plan compared to men their age.

Often we ask ourselves what we can afford on our salary. But we should also be thinking about how to leverage each paycheck to grow our money so that we can start building wealth to ensure we can afford everything we want throughout our lives. Here’s how - 1 People have investigated the coined ‘3-step wealth-building process’ you need to know to retrain your brain to be richer.

Step 1

That means regularly checking your market value—looking to see what other people in similar jobs in your area and industry are making—and ensuring that your salary lines up. It also means advocating for yourself financially. Tracking and quantifying the value you bring to your employer throughout the year can help you build the case for a raise or promotion. Also consider whether your responsibilities have evolved since you stepped into the role.

Step 2

That allows some of the money you earn to start earning more on its own. Ideally, you want to set aside 15 percent or more of your checks for your future, but you can start smaller. What’s most important is starting. Put some money into a high-yield savings account to tap in the event of an unexpected expense, like a car or home repair, or job loss. Most financial advisors recommend having enough to cover at least three months of basic expenses.

Once you have that secure foundation, invest. Buying stocks and bonds gives your money the chance to grow even more over time to really break the paycheck-to-paycheck cycle and start building wealth to cover future goals.

This doesn’t require that you be a stock market pro who can pick the right stocks at just the right time to benefit.

Step 3

One of the most effective ways to make investing a habit is by automating it. That’s not just putting the most you can from each paycheck into your account for retirement, but also transferring some money into an investment account for the midterm goals you have in the years, or decades, before.

It’s important to have a savings account to cover short-term goals and unexpected expenses. But once you’ve got those covered, funneling some money into stocks and bonds offers the potential for your money to grow significantly more over time.

You don’t need to start with a lot. As your income grows, the amount you invest can grow as well. What’s most important is getting into the habit of putting some of every paycheck to work for you.

The money that’s growing in the background of your life might one day allow you to start a business—or a family. It can help you afford a down payment on a home, or to travel around the world. It’s money that gives you choices and helps set you up to be able to provide the life you want for yourself, and maybe others, too.

It can take some work to think about your paychecks differently—as the springboard for all your wealth-building efforts, and not just money to cover bills, expenses, and short-term wants. But making that shift, and starting to put more of each check into saving and investing for your future, can be worth it as each paycheck brings you closer to financial freedom and your future goals.

Adapted from Think Like a Breadwinner by Jennifer Barrett and inspired by our founder’s favorite read by Tony Robbins - Money Matters.

Much Love,

1 People